26 Affordable and Unique Mother's Day Gift Ideas

by Matt Piqué | 17/3/2025

For parents, Christmas is a season filled with both excitement and responsibility. It’s a time to create lasting memories, uphold family traditions, and bring joy to their children’s lives.

But behind the festive cheer, a significant number of parents feel the increased financial strain that comes with celebrating Christmas.

We surveyed 2,000 parents across the UK to understand the realities of Christmas spending, from the cost of Christmas dinner to the financial pressures of buying gifts for their children. The findings shed light on the careful budgeting, early planning and tough sacrifices that go into creating a memorable Christmas.

Here’s what Christmas truly costs some families in the UK.

Many parents feel the pressure to put on a lavish Christmas feast. Here’s what our respondents shared:

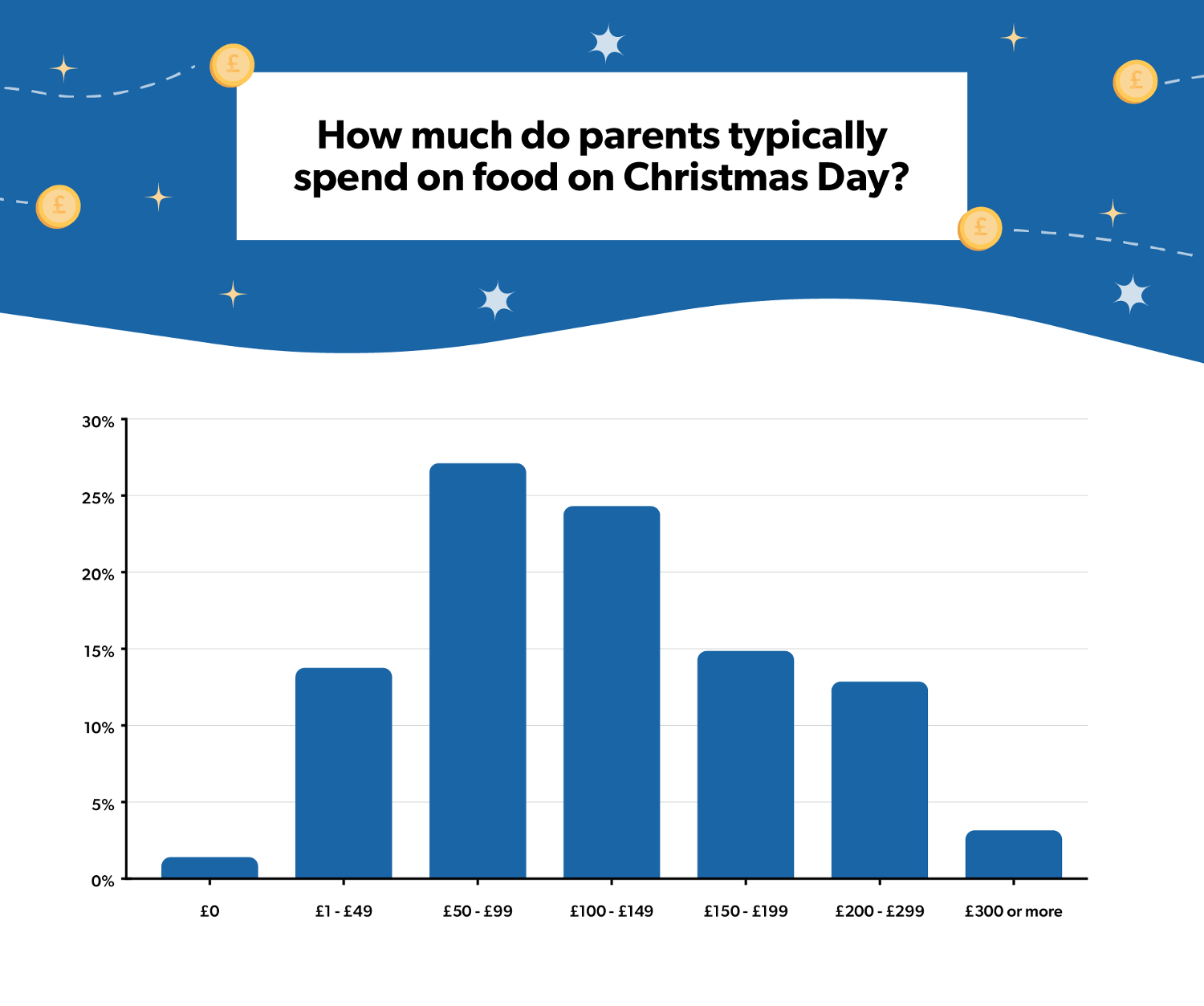

The average household spends around £145.67 on food for Christmas Day alone, with 27.1% spending between £50-£99, and 24.3% spending £100-£149. Only a small fraction (3.15%) spend £300 or more.

Early preparation: Over half (52%) of respondents start buying non-perishable Christmas foods as early as October, allowing them to spread the costs over a few months. This pre-planning can ease the pressure when it comes to managing costs, but it also highlights just how important Christmas dinner is for families.

Financial pressure: A considerable 45% feel pressured to overspend on Christmas food, and 42% have to cut back on other expenses just to afford Christmas dinner.

Budget-friendly alternatives: More than 2 in 5 (42%) plan to buy frozen or cheaper cuts of meat instead of fresh turkey as it’s cheaper, and 37% are even planning on cutting out alcohol from their Christmas shopping list to reduce costs.

Beyond Christmas dinner, gift-giving brings its own set of financial challenges for parents:

Spending per child: 1 in 4 respondents (25.5%) plan to spend £100-£199 per child, with a little more than 1 in 10 (14.5%) willing to spend £500 or more. This spending reflects a strong desire to give children a magical Christmas, even at a significant cost.

Expectations and pressure: Over half (51%) of the people surveyed worry about how their festive spending impacts their family’s financial situation, and 45% believe that spending more on gifts creates a better Christmas experience for their children.

Financial sacrifices for gifts: Nearly 3 in 5 (59%) parents are cutting back on personal spending, while 44% have taken on extra work to afford presents. Despite the effort, more than 2 in 5 (41%) parents still feel disappointed in the quality or quantity of gifts they’re able to provide.

While giving generously may create special moments, the financial pressures are real.

Household stress: Christmas food shopping alone adds financial stress to 52.3% of households.

Gift-related worries: Half of parents (50%) worry about affording gifts and other expenses for their children, and 40% say financial pressures make it difficult to fully enjoy the season.

Social pressures: Around 37% feel compelled to give gifts that match or exceed those of their children’s friends, adding an extra layer of pressure to their festive planning.

In light of these challenges, many families are exploring alternatives to maintain the festive spirit without breaking the bank.

Reducing non-food spending: To accommodate the food budget, 38.5% of people plan to cut back on decorations or gift expenditures.

If you’re looking for ways to save money on your Christmas food spending this year, check out our supermarket vouchers for Iceland, Ocado and Asda.

Ed Fleming, Savoo’s managing director comments;

“While Christmas is a time for celebration, our survey reveals that it also brings considerable financial pressure for many families."

“However, by getting creative with budgeting, planning ahead, and sometimes leaning on the support of friends and family, more households are able to focus on what truly matters - making cherished memories together, rather than the financial cost of making them."

For discounts on your Christmas shopping, visit our Christmas voucher page. Or if you’re looking for ways to save money to maximise your budget, see our guide on how to save money.

The research was conducted by Censuswide with UK parents of children aged 5-18 years between 31.10.24 to 05.11.24. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.