Five ways to cut down on pet care costs

by Rachel Lacey | 1/3/2023

The cost of living crisis is affecting everyone’s finances across the UK but what is it, what caused it and what can you do to save money on your household costs? Basically, The cost of living crisis is caused by the combination of a slow pandemic recovery, rising inflation, record energy bills, rocketing food costs and the threat of economic recession. It’s the biggest threat on living standards since the Global Financial Crisis and is set to have a severe effect on everyone, even those who tend to be a little more better off. Everyday things like re-stocking your fridge and freezer to travelling to work, your household bills or even calling loved ones on a mobile tariff, may now require a bit more consideration as you look for easy ways to save money.

With belts needing to be tightened, there are a number of savvy ways that you can reduce your outgoings, stabilise monthly expenses and ultimately allow you to keep more of your hard earned money. Whether you're looking to save money on groceries, Save money on bills or get a better deal on broadband, we're here with some realistic ways to save money: tips, tricks and even some nifty money saving apps that will help you to navigate these difficult times.

Here's how the Savoo's Cost of Living Guide will help you on ALL aspects of money saving:

by Rachel Lacey | 1/3/2023

by Rachel Lacey | 21/1/2023

by Rachel Lacey | 20/1/2023

by Laura Shannon | 5/11/2022

by Ruth Emery | 4/11/2022

by Ruth Emery | 28/10/2022

by Sarah Bridge | 17/10/2022

In all, it is already becoming clear on the significant effects the cost of living crisis is having on families, households and individuals. While it’s virtually impossible to avoid price surges, there are ways to make every day life more affordable by altering our habits and becoming aware of the areas the increases will impact us the most. With a combination of ways to save money fast, and long-term expenditure reductions, you’re sure to make some savings on unavoidable outgoings you face in the upcoming months.

We’ve spoken to a panel of money-saving experts to learn more about how else you can save money this year. From hosting Christmas on a budget to jetting off for some winter sun for less, check out these articles from professional journalists who’ve been teaching the nation to save for years!

The main factor determining the price of gas and electricity for every home and business in the UK, is the wholesale energy price. Wholesale energy prices fluctuate rapidly, and these changes are based on supply and demand, as dictated by the global marketplace. When demand for more gas and electricity puts pressure on supply, the price per unit becomes more valuable. This not only affects your household energy bills, it also affects the cost of pretty much everything that relies on energy for production. As energy cost increases, food, clothing and other essential items become more expensive to produce. This across-the-board price rise is known as inflation. To figure out how inflation has changed the value of an item or service between two years, use Savoo's free inflation calculator tool.

There are a number of factors affecting the wholesale energy prices right now:

All of this has meant that the price per unit for gas and electricity is now much higher. An energy price cap exists to ensure that customers of gas and electric companies are not being charged too much, but the price per unit of energy is now so high that the price cap is being raised to ensure gas and electricity companies can still afford to operate.

In October 2022 the energy price cap rose again. According to government sources, the previous energy price cap rise of 54% in April ‘22 was the largest on record. Based on the “average" household energy consumption, this price cap rise was equivalent to an extra £700 per year added to our household energy bills.

In October 2022, energy was predicted to increase by:

This was the largest increase on record. For average households the 2022 increases combined will be equivalent to an extra £1,600 over the year, or around £191.76 per month.

As of September 7th 2022, prime minister Liz Truss has revealed plans to freeze energy bills at roughly £2,500 per year. While initially this freeze was intended to remain in place until 2024, a governmental U-turn announced by chancellor Jeremy Hunt on October 17th means this £2,500 average cap will end in April 2023. With a new regulation indicating the price cap could be revisited and changed every three months, yet another price cap increase is predicted for January ‘23.

On top of household energy bills, household costs and grocery shopping is another area where families will feel the pinch. UK cost of living is currently at its highest rate in decades, with food inflation reaching a peak since the 2008 financial crisis.

According to NationalWorld , UK food prices are outpacing overall inflation, so the prices of food in supermarkets are increasing at a faster rate than the rest of the economy. In some cases, food prices are rising roughly 30 times quicker than the rate of inflation.

We can expect supermarket bills to climb by £533 a year, or over an extra £10 per week. According to research by NationalWorld from July 2021 - July 2022, the price everyday products has risen by:

Beyond often viewed social media posts detailing huge rises in luxuries like the much-loved Lurpak spread - food inflation is so much more than that, as people are faced with eating less and choosing between keeping their houses warm or fridges stocked this winter.

So, who is food inflation affecting? In short, the answer is, everyone! Although low-income families will undoubtedly be hit harder. Around 47.7% of households on Universal Credit are said to have experienced food insecurity, as recorded between the months of October 2021 - April 2022.

The biggest grocery price increase has been fresh food (10.5% rise) over shelf-stable products (7.7% rise), meaning that those struggling to pay bills may be forced to move away from healthier choices. Junk food and fast food are often much cheaper than nutritious alternatives. In response to this, the Food Foundation’s research has shown: ‘UK food poverty has grown 57% since January, with 7.3 million adults and 2.6 million children unable to reliably access enough affordable and nutritious food’.

Research shows that ‘lower-income households buy fewer branded products whereas higher-income households look for more deals or offers’, making it clear that the cost of living crisis and the effect it is having on groceries is being felt by people from all social groups.

An obvious solution is to avoid big brands and opt for supermarket own-brands instead. While this is an easy everyday adjustment that can make you some extra savings, we’re also seeing sharp increases of the price of ‘value’ ranges in popular supermarkets, such as Sainsbury’s, Asda, Tesco, Morrisons and even budget supermarket, Aldi. As said by NationalWorld, ‘a whopping 54% of items on offer across the five stores have had price hikes imposed on them’ since April this year, with some products even experiencing multiple increases between the months of April - August 2022.

>According to Confused.com, around 65% of UK workers who have spent some time working from home during lockdown periods have managed to save hundreds of pounds, train commuters being among those who splash the most during their daily commute.

On average, those who travel into work by train spend £136 per week, while those making their way in by car spend around £80 per week. These figures include any expenses which wouldn’t have arisen while working from home, such as lunches out, coffees, a trip to the pub after work, and more. While the move to two days a week office working, now implemented by the majority of companies, has undoubtedly lowered costs for commuters, saving them roughly ‘£82 a week or £328 over the course of a month’ - commuting can now be considered an additional expense since the Covid-19 pandemic.

While public transport services and train fares often steadily increase throughout the years, the government announced, ‘many train fares will rise below the rate of inflation next year to help travellers cope with the cost-of-living crisis’.

Before the pandemic, an annual increase was introduced to take place in January each year, which, in response to the cost of living crisis, has now been frozen until March 2023 to help struggling commuters and households in general to cope with simultaneously rising costs across various areas of our lives. This, however, only accounts for around 45% of rail fares - so those travelling frequently may still see some rise in costs this coming January. To put into perspective just how much fare hikes affect commuter journeys, tickets prices saw a rise of up to 3.8% (largest increase in almost a decade) in England and Wales earlier this year, meaning that people could now have added over £100 extra to the cost of annual season tickets.

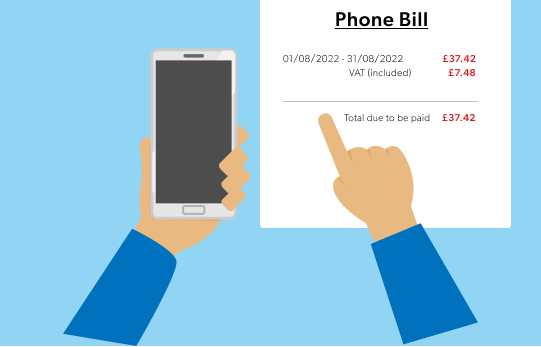

Staying connected, keeping up with loved ones virtually or digitally, having constant access to the internet, and streaming our favourite shows have all become daily occurrences in modern life. After long periods of lockdown, being able to speak to our friends and family from a distance has become more commonplace than ever before, with many people adapting to this new way of socialising. With prices including our telecoms service increasing, many households are considering whether this is something they can afford to continue.

According to Ofcom data, around 5.7 million households currently facing financial difficulties as a result of the cost of living crisis, will feel an impact on their communication services, such as mobile phones, broadband and landlines. This meant that in April, around 22% of low-income families reduced their spending elsewhere to offset losing these services, while 13% of middle-income families did the same. As put by Which?, the fact that households are choosing to reduce their outgoings in other departments to be able to afford these services, emphasises how integral they are to life as we know it today.

From April this year, millions of people across the country experienced increases in their phone bills, tariff changes, broadband and TV services, plus more.

To support people struggling with these new prices, the government has worked with the telecoms industry to help make these services affordable and readily available for households that rely on them.

Providers such as BT Group , Openreach, Virgin Media , O2 and Sky have pledged increased support and cheaper prices for the households finding it difficult to keep up with rising bills and the cost of living crisis with a range of low-cost plans and cheaper deals. Those who claim Universal Credit, will be able to switch to a cheaper package penalty-free or make the most of new mobile tariff options, created as part of this initiative.

While browsing the internet, catching up on your TikTok feed or bingeing your favourite series may feel like bottom-barrel concerns in comparison to the crisis faced by many people this winter, telecoms services often mean so much more than that. Lower prices mean that even the most vulnerable of households can stay connected to loved ones and worldly affairs during the cost of living crisis, reducing very real concerns of isolation.

As we’ve just discovered, the Cost of Living Crisis is essentially an inflation crisis caused by multiple factors - the war in Ukraine and a slow recovery from the Covid19 pandemic especially. The knock on effect of has caused energy and food prices to increase, leaving many families and household struggling. On top of this, the energy price cap increase is set to make this terribly Winter bleak for most. At Savoo, we’re committed to helping our users save money on their online shopping - we’ve got thousands of discount codes and deals ready and waiting for you to use to help you cut your household costs. On top of that, our expert writers have compiled an extensive list of the top ways to save money around the home - from energy bills to grocery shopping, our handy money saving tips will help you keep in control of your finances.

This package of support from the government will see a relief on energy bills for all domestic households, worth £400. Paid in 6 monthly deposits directly to the energy companies, customers will notice £66 off their bills in October and November, and £67 off in December, January, February and March. The discount is automatic, meaning you won’t need to do anything to claim this. Keep an eye out for this saving on your bill invoices.

The best thing? This is a discount, not a loan, meaning you don’t need to repay it at any time!

For those that need it, there is extra support available, additional to the £400 discount. Qualifying groups of people are: those receiving Universal Credit, people on disability benefits, and people of the state pension age.

There are plenty of free services available for those struggling with money. If you or a loved one needs free financial advice, is worried about upcoming fees, or has fallen into debt, there are several no-charge phone numbers you can call to talk things through with an agent.

If you’re struggling with money or foresee difficulties in your financial future, it’s well worth seeing what benefits and grants you could be eligible for. With hundreds of options for people in different circumstances, you could find that financial aid greatly relieves money pressures. Two government-approved calculators are the Entitledto and Turn2Us calculators. Turn2Us also has a grant search function. Furthermore, you could be entitled to the WaterSure Scheme, Cold Weather Payments, Winter Fuel Payments, or the Warm Home Discount Scheme.

The watersure scheme places a cap on your water bills, provided you meet a number of criteria. Firstly, you must have a water meter, or be in the process of having one installed. Secondly, you need to be on benefits AND have a “high essential use of water" because you either A) have three or more children aged under 19 in full-time education living in the property, or B) someone living in the house has a medical condition requiring them to use a lot of water. You can obtain a form from your water company, and you will either be approved or not based on the documentary evidence you provide.

This scheme is active between November 1 and March 31. If the weather in your area is, or is predicted to be zero degrees C or below for longer than seven days consecutively, you could be entitled to a payment of £25 for every week these weather conditions continue. Cold weather payments are available for those already on benefits, including but not limited to income support and Universal Credit. Further eligibility criteria can be found on the Gov website. This scheme is automatically applied, so you do not need to sign up to receive it. However, it is worth checking your eligibility so you can chase payment if you are eligible but do not receive it.

The Winter Fuel payments are specifically to help those of retirement age with the cost of heating bills during the winter months. Those born on or before September 25 1956 could be eligible for an additional £250-£600. If you receive the state pension OR another social security benefit you should be paid automatically between November and December, and payment should have arrived with you by January. If you’d like to receive it but don’t receive any of the aforementioned benefits, you can make a claim by phone or post using your National Insurance number and bank details.

The Warm Home Discount scheme operates from November to March, and functions as a one-off discount that is paid to offset energy bill costs. The previous year’s scheme (2021-2022) was worth £140 off. You can apply in multiple ways, and the way you apply will be based on the way in which you are eligible for the scheme.

You should also contact your supplier to see if you can get the discount for both gas and electricity if you are with the same provider for both.The comparison tool is free, as well as the contact phone number. Switching is also completely free and they do all the work for you. From new energy customer discounts to free vouchers, cheaper tariffs, and lower sign-on charges, Energy Helpline is a no-cost way to switch up suppliers and potentially save in the process.

Third Party Deductions are payments of fines from overdue household bills and/or rent that come directly from your benefits to the third party, without touching your account. While this does not save you money, it is key in helping to manage a small income and budget effectively for essentials. This scheme can be applied for if you receive benefits like Universal Credit, Pension Credit, income-based Jobseeker’s Allowance, and more. To apply, contact Jobcentre Plus and provide them with your customer number, National Insurance number, and details for the payment you wish to add to your Third Party Deductions. You cannot be given a final notice to pay the debt you are paying off while part of this scheme. Payment of your current monthly bills can also be automated using this scheme, but will stop once you have paid off all remaining fines.

While these tips will not save you a lot, over the course of the year they will help make your energy use more efficient and save you some money alongside other methods:

Replace your bulbs with LED lights

LED light bulbs are more efficient, meaning it takes less electricity to light up your rooms. According to the Energy Saving Trust, you could save as much as £13 per bulb per year, depending on which bulbs you currently use.

Block drafts and have the curtains closed more often

You lose a lot of warmth in your home through the windows and in places you have drafts. By closing the curtains earlier in the evening or leaving the curtains closed in certain rooms when you are not home, you can trap more heat in.

Locate drafts by lighting a tea candle and holding it near where a suspected draft is. If the flame flickers, that means there is a draft entering your home in that area. A quick and cheap way to patch a draft is to use caulk or shrink wrap, which work well on a drafty window. You can also use an old rolled-up towel as a door stop.

Cook in bulk

Cooking one large batch of food might take slightly longer and use more gas, but you can freeze portions for the week and save energy by quickly reheating food rather than cooking a new meal from scratch most nights of the week.

Charge your phone and fill up a battery pack at work

A self-explanatory tip; charge your phone at work instead of leaving it plugged in overnight. You can also bring a battery pack which can then be used to charge headphones, tablets, and laptops, or to power small household appliances that use USB-style ports.

Add foil behind your radiators

Adding foil behind your radiators helps bounce some of the heat away from the walls and into your room. Instead of the heat of the back side of your radiator entering the wall, most of it reflects back into the room to add additional heat.

Move furniture away from the radiators or heaters

Having furniture very close to radiators allows the furniture to absorb the heat. You might have a very warm sofa or bed frame, while the room itself takes longer to heat as a result. To warm your home quicker, make sure soft furnishings are away from the radiators to allow the heat to travel easier around your rooms.

Heated mattress topper

If you can afford one, a heated mattress topper is a great alternative to keeping the heating on overnight to stay warm while you sleep. With an average wattage of 65, the blanket will use 0.455 kWh of energy over a 7 hour period. Based on predicted energy costs in October (£0.52p per unit rounded to the nearest penny), the blanket will cost a mere 24p to run every night. If used 7 hours a night for 6 months of the year, that is a total of £43.80.

It’s easy to worry about the rising total on your grocery receipt, but there are some simple ways to keep costs lower which should help to offset the higher price tags we’re seeing on shelves. For example, a neat tip by savings expert Alex Fullerton is to choose a bar of soap over various types of cleaning products - “Not only will it last you ages, it’s a more sustainable purchase than plastic bottles of liquid soap or shower gel. New formulations are less drying than in the past, too."

Some of these tried and true methods of saving might already be part of your weekly shopping routine, but combined you could make some serious savings over the course of the year.

We’ve all heard the saying about shopping on an empty stomach being a recipe for disaster. One of the best ways to combat costs in the supermarket is by planning your weekly meals in advance, sticking to specific recipes and only buying what you need to eliminate the problem of waste. Beyond risky impulse buys and satisfying at-the-time cravings, you can guarantee everything in your fridge will be used up. If you need some inspiration on cheap recipes to get you through the week, you’ll find a wide range of ideas online. The BBC for example, has a collection of ‘budget recipes’, similar to Tesco, as well as Jamie Oliver’s ‘cheap recipe ideas’, plus many more!

If you have a favourite supermarket, it’s well worth pledging your loyalty and signing up for their rewards scheme, because it will save you money on future shops. Beyond simply earning points, loyalty schemes are also a great way to access exclusive discounts and rewards, but available to members only. According to Which?, you can save ‘between 50p and £10 for every £100 you spend with the loyalty schemes on offer today’. While Tesco’s Clubcard may be the most well-known for allowing members to collect one point for every £1 they spend in-store and online, as well as discounted prices on selected products - there are so many more supermarket loyalty schemes if you prefer to do your shopping elsewhere. The Asda Rewards loyalty scheme was newly launched this summer 2022. The smartphone app enables customers to collect 'Asda Pounds' by buying specific products or completing set missions. Iceland’s Bonus Card adds an extra £1 savings for every £20 you save using your member’s card, and Sainsbury's Nectar scheme means you can earn one point per £1 you spend online or in-store. These are just a few of the loyalty schemes you can join, as Lidl, Co-op, M&S, Morrisons and Waitrose also offer fantastic discounts.

Buying selected items when they’re in season means they’ll be more easily available and listed for lower prices. It's also better for the environment as it means the fresh fruits and vegetables haven’t travelled too far to reach your local supermarket, while also a whole lot tastier and nutritious as fruits and vegetables thrive most when they’re in season. Because in season items are less travelled and available in abundance, prices are considerably lower. Take advantage of multibuy deals and freeze what you can’t use straight away. Sounds like a win win to us!

While we’re often told that fresh is always better, in the case of fruits and vegetables this isn’t always necessarily the case. Buying frozen fruits and vegetables is almost always cheaper than buying them fresh, so this is a great way to save a few extra pounds during the supermarket price surge. While, health-wise, you’re in the clear, frozen alternatives may not always retain the same texture. As suggested by the Evening Standard, a great way to cut down your supermarket bill is by saving your fresh fruit and veg for when you’re eating them alone, and go for your frozen fruit and veg when you’re making smoothies, curries, stews, and any other dish that will make it difficult to tell the difference!

Have you ever noticed the amount of yellow sticker reductions available during impromptu evening supermarket trips. Visit your local supermarket just before the end of the day, and you’re sure to find savings across a selection of discounted products soon to be out of date for a fraction of the price. What’s the point of purchasing products towards the end of their shelf life, you ask? Well, be sure to check whether the food items are freezable, and you’ll be able to give them so much more life, while giving your wallet a break too!

Commuting, which was previously taken as something we needed to do for granted, is now starting to be viewed as ‘optional’ as people are becoming more strikingly aware of the cost it sets us back to travel into the office each week.

For some, going into work is not simply about travelling there and back, but the entire day or week as a whole. Many don’t want to give up the social aspect of office culture, but heading into the office more often means you’re spending more on childcare, lunches or visits to Pret - it all adds up.

With childcare costs and nursery prices rising, it’s becoming increasingly more difficult for parents to manage their personal and professional lives affordably. According to Coram, a children’s charity, 2021 survey, ‘the average cost of sending a child under the age of two to nursery for 25 hours per week in Great Britain rose to £7,160 a year in 2021. In 2020, it was £6,800 a year’ - a significant increase for parents battling rising costs within all aspects of their lives now in 2022.

To make office trips more affordable, or get the real benefits of working from home, we recommend:

Whether you’re splitting your time between your office and home, or you’re going fully remote, you’re bound to save some money. Rather than letting this amount pile up in your account, where it easily becomes spendable, consciously make the effort to put this amount into your savings account to really feel the difference. When going into the office, you’ll undoubtedly spend money on train fares, lunches out, takeaway coffees and beers after work - this could seriously add up by the end of the week! As these typical outgoings have now been significantly reduced or are non-existent altogether, this is the perfect opportunity to begin building yourself an emergency fund.

Did you know that the government currently offers tax relief for those working from home? While you can expect to save heaps of money from spending some of your working week at home, it’s also the case that spending more time indoors will inevitably raise your gas and electricity bills, as well as food costs, water charges and more. To help with this, the government offers tax relief on £6 a week from 6 April 2020, meaning that if you’re currently paying 20% tax (the basic rate), and claim tax relief on £6 per week, you’ll get an extra £1.20 per week in tax relief.

When considering your need to buy a season ticket, a key thing to consider is how often you’ll be travelling and whether it even still saves you money if your office days have decreased. While a season ticket often works out cheaper for those travelling five days a week, it may not be the best option if you’re now only required to be in two or three days a week. Money saving expert at MoneySupermarket, Jo Thornhill, suggests to consider factors like the times you’re travelling and whether you can make the most of off peak hours, how many days you’re going into the office, and how much single tickets cost in comparison, helping you to work out the difference and really map out your savings. Beyond that, it’s also worth considering National Rail’s new Flexi Season Ticket which may be a better option for your needs. The Flexi Season Ticket allows you to make your journey 8 days out of 28, during any time between two stations. This option gives part-time commuters a way to save money while travelling during peak hours. It also makes sense checking if you can split ticket cost for journeys, as suggested by our expert contributor Rachel Wait in her article Easy Ways to Cut Your Travel Costs.

An easy way to make a huge difference to how much money you’re spending is by cutting out unnecessary costs when heading into the office. Whether you get swept up in various food vendors, restaurants and takeaway spots near your building, or the office coffee machine doesn’t quite compare to your favourite independent spot or top pick chain store - even the little costs pile up! Consumer finance specialist, Sarah Pennells, claims: ‘Cutting that takeaway coffee to once or twice a week, or preparing a few of your meals at home, will add up to meaningful savings over a year. Reducing your spend by just £2 a day could save you more than £700 a year.' We’ve already covered tips on how to combat increased costs in supermarkets, so we’re sure you’ll be able to start preparing cost-effective lunches in no time!

If you’re struggling to afford childcare while working, it’s important to take advantage of any support offered to you. Parents who have three and four year olds for example, can claim 30 hours of funded childcare a week through the government! Many people don’t know about the Tax-Free Childcare scheme as it’s not widely advertised, so you could be missing out massively. The scheme allows you up to £500 every 3 months, or up to £2,000 a year for each of your children. However, if your child has a disability, you’re entitled to up to £1,000 every 3 months, or up to £4,000 a year. To make the most of this benefit, set up an online childcare account, and for every £8 you pay into this account, the government will pay in an extra £2 to help you cover costs. Better yet, you can enjoy the Tax-Free Childcare scheme on top of your 30 hours of free childcare, so ensure you’re eligible for both.

If you’re struggling to stay connected during the cost of living crisis or if you foresee difficult decisions regarding your budget in the upcoming months, there are some methods you can use to cut down your phone and broadband bills. These are great ways to save money on a tight budget because they allow you to reduce your basic monthly outgoings and increase your discretionary income as a result.

If you’re unsure of what will work out cheaper for you, we recommend doing some research into SIM only and contract deals depending on your usage and needs. If you already have a working phone in good condition, for example, it may be worth considering a SIM only deal as these offers come with calls and texts plus data for a monthly cost - typically lower than the price of a contract deal. However, if you’re in need of a new mobile phone and can’t afford to pay for a handset outright, a monthly contract deal might suit you better. While the new phone feels ‘free’, you’ll be paying off for it slowly as part of your monthly cost - which, if you're not keen on another ‘debt’ or monthly pay out, might be something for you to consider.

What are social tariffs?

If you’re having trouble paying for your mobile tariff or broadband service, it’s well worth speaking to your provider about whether you’re eligible for one of the new social tariffs - introduced to make telecoms more affordable for low-income families hit by the cost of living crisis.

So, what are these cheaper packages and low-cost plans? According to the Mirror, ‘Social tariffs are special discounted deals available for certain low-income customers.’ They are heaps cheaper than typical prices or standard deals offered online - so it’s worth checking to see if you’re eligible. Starting from just £14.40 a month, with no exit fees too, people who will rely on social tariffs in these coming months can rest assured that moving to one of these plans is a viable means of financial support.

You’d typically need to be claiming a government benefit, such as Universal Credit, to qualify for one of these tariffs, but it’s worth calling your provider for more information. You should even consider switching to another provider offering a better deal if you’re coming to the end of your current contract.

Highlight top tip from our savings expert,Sarah Bridge

“Put a note in your diary two weeks before your travel, house or car insurance [or other annual tarrif] comes up for renewal. That way you have time to compare other prices and let your current insurer know that you’re going to switch unless they match the best deal."

There are, of course, two separate definitions of saving money - 1) making your outgoings cheaper by finding deals, discounts and tricks to be more efficient with your spending and, 2) finding techniques and tools to physically save money by diverting it from your expenditure so you can save a pool of money that can then be used elsewhere. It’s mainly the second that we’re going to talk about now.

From switching your bank account for a welcome bonus to claiming cashback on your shopping there are a variety of ways you can save more money - leaving you with spare cash for emergencies and to treat yourself. We’ve even compiled a handy list of top money-saving apps.

It's easy to lose track of monthly subscriptions that are usually paid by direct debit. The money for them disappears from your account each month, but do you really need them? From streaming services like Netflix, Hayu, Now TV and Amazon Prime to other outgoings like gym membership and magazines, subscriptions can do a lot of damage to your bank balance, especially if you’re not actively using them.

A good place to start is to make a list of all your monthly outgoings, and then identify the ones that are really essential. You will probably find that many of the services you have signed up to can be dropped or paused. The Rocket Money app can be used to identify your subscriptions so you can stop paying for things you no longer need. For convenience, they can even cancel subscriptions on your behalf.

In many instances there will also be free alternatives like free gym passes, free music streaming, on-demand TV services and entertainment apps like FreeVee that won’t cost you anything extra. You could also consider splitting the cost of streaming services with friends or family in your household if you can’t bear to do without. Finally, we suggest having a search on Savoo for a discount code as a super easy way to save money on your subscription services without having to cancel or downgrade your account.

Loyalty rarely pays with subscriptions, so it may be time to play hard ball and threaten to cancel your subscription. According to our savings expert Sarah Bridge, “There is a high chance that you will be offered a substantial discount to remain as a customer, especially for newspaper subscriptions and some streaming services."

Surprisingly many people don’t bother to claim cashback when shopping online, but with finances getting stretched you should definitely start, because you can make £100’s per year when using the money-saving feature correctly. There are lots of free cashback sites who will pay you for doing your online shopping via their sites, although some will have an annual subscription cost which will often reward you with increased cashback.

Ranging from a few pence for groceries to over £100 for some mobile or broadband contracts, you can quickly build up a good amount of money from what is basically free cash every time you shop. Cashback apps in particular are a convenient way to earn money, with some paying out on in-store purchases. Some cashback apps like Daali also connect to your debit card, and will reward you automatically every time you spend on it. Get cashback on a whole host of places, including regular hot picks like Amazon, UBER and McDonald’s.

Companies like Currys and Samsung also offer cashback on tech products occasionally. When buying a new appliance or the latest mobile phone you can sometimes get cashback directly from the manufacturer, so it’s always worth checking what promotions are available.

It's wouldn't be a Savoo article without mentioning the impact of the cost of living crisis on charitable donations.

In a recent webinar by the Chartered Insitute of Fundraising, they highlighted the impact of inflation on charitable fundraising. According to UK Giving data, the £5.7 billion in charitable donations made during the first half of 2022 are now worth just £5.2 billion, just a few months later. With consumer insecurity on the rise, correlating with rising inflation, and public spending cuts from the government, charities face large obstacles when it comes to fundraising.

By creating an account with Savoo and choosing the charity you'd like to continue supporting, you can shop at the stores you would usually do and we will donate to charity on your behalf for free. Find out more about how our fundraising model works here!

Could you go an entire day without spending a single penny? Having at least one no-spend day a week can be surprisingly useful in changing your attitude to splashing the cash. From planning meals in advance to reviewing travel options, the activity takes a bit of planning but should make you become a lot more careful with money in the long term. Get friends and family involved to provide some moral support, and with a little self-restraint you’ll be quids in by cutting out little treats like coffee and snacks.

If this one proves to be too much of a challenge, setting yourself a daily limit should also have a similar outcome.

Highlight top tip from our savings expert, Laura Shannon.

“It’s a pain-free way to pay yourself – and there are some great perks. Cash bonuses, better savings rates, and no fees for card-use abroad are all good examples. Use the current account switch service so everything is transferred automatically. It’s a decent boost when money is tight."

Your smartphone can be a great tool in your push to save money. The mobile phone has transformed pretty much everything we do in life, and saving money is no exception. Knowing where to find financial help and support is often difficult, but that device in your pocket is a powerful weapon in achieving your saving goals. There are many hundreds of great apps out there with the sole purpose of helping you save, with most being free as an extra bonus.

From personal finance apps to shopping apps, we have collected together a proven selection of apps that should help you navigate the cost of living crisis and wider financial issues.

Idealo - Take away the manual process of comparing prices when shopping online or in-store with the free Idealo app. Available on iPhone and Android, the useful app is perfect for those impulse purchases that you live to regret because you find them cheaper elsewhere. Simply search for an item or scan a barcode and Idealo will inform you what the price is at other retailers via geolocation. It could be that a short walk to a different store could save you serious money. Paying the lowest price is always supremely satisfying!

Mint - The Mint app is simple, usable and has smart financial tools that will make a real difference to your money management. The app lets you connect all of your online finance accounts, check your credit score and provides you with a good estimate of your net worth. Mint uses bank-grade security to ensure all your details are safe and can help you to set financial goals. Available for Android and Apple, the Mint app will prove to be a useful addition to your money saving activities.

ATM Locator - As the name suggests, the ATM Locator app has just one purpose - to help you find free cash machines to use. ATM charges can be extortionate, so there are genuine savings to be made from the Android app. More generally, some good advice for people keeping track of their finances is to use cash more. With 9 in 10 card payments now contactless, it’s very easy to lose track on how much you’re spending. Research has shown that people spend less when cash is in their hands, so ditch the debit or credit card for a bit and embrace physical money again.

Meter Readings - With energy prices going through the roof, it’s a good idea to be monitoring your utility bills. The free Meter Readings app for iPhone allows you to keep an eye on how much you're spending every day. Forget taking long showers or leaving your tech on charge for days on end, don’t wait until the dreaded bill arrives before you take control of things. While it has some in-app purchases available, the app should help you to save you money with helpful tips about switching providers and even a comparison with what your neighbours are paying.

Annual tariff costs: how much you will pay for gas and electricity annually. Calculated as follows: (your total energy use over the past 12 months x the rate per unit) + (the daily standing charge x 365 (days in the year)) = your annual tariff cost

Crude oil: oil that is pulled from the ground and used to make petrol and diesel

Daily standing charge: the fee you pay to have your home connected to the energy grid in Great Britain

Discretionary income: the part of your budget that is left once all essential living fees have been removed (eg: taxes, rent, utilities, food bills). This is not to be confused with disposable income which is the income that reaches your bank after taxes have been deducted, but before any other cost of living expenses have been paid.

Energy price cap: a maximum price you will be asked to pay per unit of gas and electricity. The cap also applies to the daily standing charge

kWh: (“kilowatt hours"), the way energy usage for an appliance is measured. Calculated as follows: (wattage x number of hours it is in use)

Ofgem: (“Office of Gas and Electricity Markets"), the independent regulator of Great Britain’s energy

Wholesale energy price: the price at which energy suppliers purchase their energy. This price is affected by demand based on global events, the weather, other market prices and international currency